Eight Signs You’re Ready to Switch to NetSuite ERP

A version of this article appeared in the Denver Business Journal on August 19, 2024.

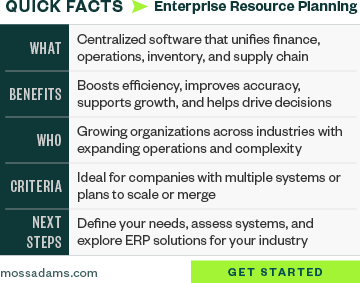

QuickBooks works well for small- to medium-sized businesses looking for easy-to-use accounting software. But as a business grows, so does the need for a more sophisticated enterprise resource planning (ERP) software that offers increased functionality.

Recognizing when it’s time to upgrade, however, can be a challenge. Following are eight signs your business could benefit from NetSuite ERP.

Managing Spreadsheets Takes Too Much Time

Microsoft Excel spreadsheets are useful for many things, but not for running a company.

Excel doesn’t accommodate automatic sharing of data and uses up employee time entering data manually.

QuickBooks also uses up employee time in manually creating invoices and spreadsheets. Using QuickBooks for accounting can require workarounds and reminders for functions that aren’t automated, like breaking down annual fees by month. Using Excel to track deferred revenue, allocations or recurring payments is too time-consuming to be scalable.

In NetSuite, payment schedule processes are automated, eliminating the risk of an accountant forgetting to record a payment each month. This automation frees up employee time for more significant tasks.

Manual Processes Create Errors

Manual data entry can be prone to human error and requires regular checks. Revenue recognition is a common cause of delay with QuickBooks.

Automating data is more reliable and makes month-end reconciliation more straightforward. QuickBooks’ use of spreadsheets adds a layer of work and delay to digesting data.

With NetSuite, all employees use the same system, and information is updated in real time, meaning it’s consistently accurate.

Inaccurate Data Prevents Informed Decision-Making

Being ready to make decisions quickly is vital to businesses of all sizes. Forecasting and budgeting are crucial to success. Leaders need accurate data; error-prone data makes comprehensive business insights impossible.

QuickBooks’ limited data reporting capabilities make these tasks difficult.

NetSuite easily generates data reports. Unreliable data and a lack of reporting can put your business at risk. It adds a segregation of duties function, preventing the same person from paying and approving a bill and eliminating a risk factor for accounts payable fraud.

Audits Pose Concerns

Sufficient internal controls around approval workflows, separate roles, and audit controls simplify auditing. Without these features, a company can have more trouble accessing a loan, pursuing funding from investors, or going public. These all require solid numbers.

NetSuite can be used to access logs and workflows helpful in audits and locate transaction details.

NetSuite can track inventory for compliance through receiving, moving, and shipping. When an audit is required, it can generate a report, saving the trouble of tracking down various documents.

NetSuite has a customizable general ledger with various segments allowing you to setup your GL to meet your business needs. Users can add custom GL impact lines to transactions, such as invoices or vendor bills, across single or multiple accounting books, reducing the time and effort required for account reconciliation, period close, and audit processes.

Your Business Is Growing

A business using QuickBooks and managing more complex issues with consultants and workarounds will outgrow it quickly.

If your company is growing, you’ll need tools to track new revenue sources and consolidate data. This becomes more complicated if your business expands into multiple entities that can’t share software.

It’s Hard to View Activity Across Your Organization in Real Time

Visibility into processes is essential to a growing, changing business. You’ll need to make informed decisions about next steps and obstacles.

Sharing information about priorities across departments, teams, and among managers priorities keeps workers from getting siloed.

Clarity around your supply chain, from manufacturing to delivery, especially when it includes international regulatory requirements and government tariffs, can cause delays or shortages.

Keeping inventory and financial information in the same system lets companies track inventory and value in real time.

NetSuite provides employees the same data, updated in real time, benefiting both employee and customer.

Billing Processes Affect Your Forecasts and Cash Flow

Accurate forecasting of payments is important for cash flow. Automating subscription billing and project accounting simplifies those processes, saving time and reducing the potential for errors.

NetSuite makes real-time visibility into billing and financial activity possible. You can consolidate invoicing, automate rating processes, and support multiple pricing models.

NetSuite works well for billing subscriptions and automating renewals. You’ll be freed from manually monitoring and tracking changes and be able to customize prices and discounts.

Your Data Is Hard or Impossible to Analyze

NetSuite offers a central hub for data, combining accounting functions and compliance management. You’ll be able to track financial data in real time and generate statements and disclosures compliant with Financial Accounting Standards Board Accounting Standards Codification® Topic 606, US generally accepted accounting principles (GAAP), Sarbanes-Oxley Act of 2002 (SOX), and more.

In addition to pre-configured features such as key performance indicators (KPIs) and workflows, NetSuite offers dashboards you can customize to align your operations and accounting processes.

We’re Here to Help

If your accounting software creates challenges rather than aiding in the management and growth of your business, contact your Moss Adams professional. Visit our NetSuite Implementation Services for additional resources.

About NetSuite

From fast-growing startups to global enterprises, NetSuite powers businesses across a variety of industries. NetSuite provides cloud financials, customer relationship management (CRM), e-commerce, human capital management (HCM), and professional services automation management for all organizations from fast-growing midsize companies to large global organizations. Additionally, each component of NetSuite is modular, enabling it to be deployed and integrated with existing investments as required.

With more than 36,000 customers running NetSuite worldwide and dependent territories, some of the world's most innovative organizations trust NetSuite and take their financial and operational processes to the cloud.